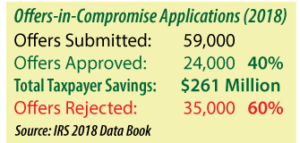

How confident are you in the approval of your compromise offer application? In 2018 the IRS approved 40% and rejected 60% of Offers In Compromise. Therefore, If your tax debt is large, play it safer—get expert help.

Call Tax Representative Jim Payne, CPA in Gainesville, Florida to organize and evaluate your unique financial details. When that’s done, Jim will use custom software to generate your Reasonable Collection Potential (RCP), using the same formula as the IRS does to determine the lowest dollar amount they will approve for a compromise offer. Beyond that, Mr. Payne can suggest actions to improve your RCP profile so you keep even more of your money. For a free phone consultation, call 352-317-5692.

Call Tax Representative Jim Payne, CPA in Gainesville, Florida to organize and evaluate your unique financial details. When that’s done, Jim will use custom software to generate your Reasonable Collection Potential (RCP), using the same formula as the IRS does to determine the lowest dollar amount they will approve for a compromise offer. Beyond that, Mr. Payne can suggest actions to improve your RCP profile so you keep even more of your money. For a free phone consultation, call 352-317-5692.

The Offer-in-Compromise (OIC) is real federal tax relief — a fresh start program. It’s an agreement wherein the IRS accepts less money—perhaps a lot less money— than you legally owe. This is the pennies-on-the-dollar ‘promise’ you hear on TV and Web ads. But watch your step. Preparing a compromise offer for a large debt is not a do-it-yourself project, and offer-in-compromise services are not all equal.

Silver-Tongued OIC Talk?

Silver-Tongued OIC Talk?

Do you see the problem with most offer-in-compromise (OIC) service pitches? They’ll have you believe the IRS accepts low offers because some silver-tongued fellow talked them into it. That is simply not true. As stated above, the IRS uses the Reasonable Collection Potential formula to decide what compromise amounts they will accept. The formula works with your current assets, expenses, and predicted future income over a specific time period. Most OIC services (and many are pure scams) promise to quickly settle your IRS tax debt for pennies on the dollar then simply fail to help you get your low offer accepted. Worst case, you’ll pay a stiff fee for no benefit at all— then end up losing key assets such as your home and cars to IRS liens and levies.

At best, you’ll end up with an IRS payment plan, which can buy you time, but not save you any money. And if you owe a lot — you’ll have to live with the constant pressure to keep up with big monthly payments. Not a fun way to live.

Let’s be real. The IRS is not a desperate negotiator. They have other tools to get your money. Submitting an Offer-in-Compromise for a sum that is much lower than the amount generated by the IRS Reasonable Collection Potential formula is a waste of time. The best approach is to have an independent tax advisor like Jim Payne, CPA—someone you can sit down with who will closely examine your unique finances and guide you step by step in crafting a compromise offer that meets IRS guidelines while saving you the most money. For a free phone consultation, call 352-317-5692.

Let’s be real. The IRS is not a desperate negotiator. They have other tools to get your money. Submitting an Offer-in-Compromise for a sum that is much lower than the amount generated by the IRS Reasonable Collection Potential formula is a waste of time. The best approach is to have an independent tax advisor like Jim Payne, CPA—someone you can sit down with who will closely examine your unique finances and guide you step by step in crafting a compromise offer that meets IRS guidelines while saving you the most money. For a free phone consultation, call 352-317-5692.

Get Tax Rep Help to Prepare Your Lowest Offer to the IRS

At Tax Rep, we are pleased to offer a free phone consultation (352-317-5692) so you can describe your situation to Tax Advisor Jim Payne, CPA. Jim will answer your questions and give you his initial view of the best solution for your tax debt. If it’s an Offer-in-Compromise, the next step is an in-person meeting. Mr. Payne will help you organize the extensive financial details the IRS requires for a compromise offer. He will help you navigate the Fresh Start program options.

Restructure Assets and Expenses to Improve Your RCP Profile

Following analysis, Jim can also suggest legal actions you can take to lower asset values and increase expense totals. These numbers are run through Tax Rep software using the same formula the IRS employs to determine your Reasonable Collection Potential and thus, what constitutes an acceptable offer-in-compromise. The result: More money stays in your pocket. Peace of mind. Don’t delay. Email or call Tax Representative Jim Payne, CPA, at 352-317-5692 for a free initial phone consultation.