IRS Collections vs. Debt Collectors: Key Differences

This is a subtitle for your new post

Some people assume IRS collections work like any other collection agency.

They picture phone calls, letters, maybe some pressure—but ultimately something that can be negotiated, ignored for a while, or dealt with later. That assumption is one of the most expensive mistakes taxpayers make.

The IRS is not a collection agency. It is a federal enforcement authority with powers that private collectors simply do not have.

A regular collection agency must rely on contracts, court judgments, and state law. Before it can seize anything, it usually has to sue, win, and then take additional legal steps to collect. Even then, its options are limited by exemptions, procedural delays, and the cost of enforcement.

The IRS operates under a completely different framework.

Once a tax is assessed and required notices are issued, the IRS has administrative collection authority. It does not need a court order to act. It can levy, garnish, and seize under federal law, on its own timetable.

For example, the IRS can levy bank accounts without going to court. Funds can be frozen and swept once the levy process is complete. A private collection agency cannot touch a bank account without first obtaining a judgment and following state-specific procedures.

The IRS can also garnish wages administratively. Unlike most wage garnishments, which are limited by federal and state caps, IRS wage levies allow only a minimal exempt amount for basic living expenses. For many taxpayers, that means most of their paycheck is subject to levy.

Where the IRS’s authority becomes even less intuitive is retirement assets.

In many circumstances, the IRS can step into the taxpayer’s shoes with respect to pension plans and retirement accounts. If the taxpayer has a present right to receive distributions, the IRS can levy those rights. This includes pensions, retirement plans, and other deferred compensation arrangements that private creditors often cannot reach or can reach only with significant restrictions.

A regular collection agency is generally blocked from accessing retirement assets by ERISA protections, state exemption laws, and plan restrictions. The IRS is not bound by those same limitations.

The IRS also has the power to seize and sell property, including vehicles, business assets, and in some cases real estate. While seizures are not routine, the authority exists and does not require a court judgment.

In addition, federal tax liens attach broadly to current and future property interests, affecting credit, refinancing, and asset transfers in ways private collection efforts cannot replicate.

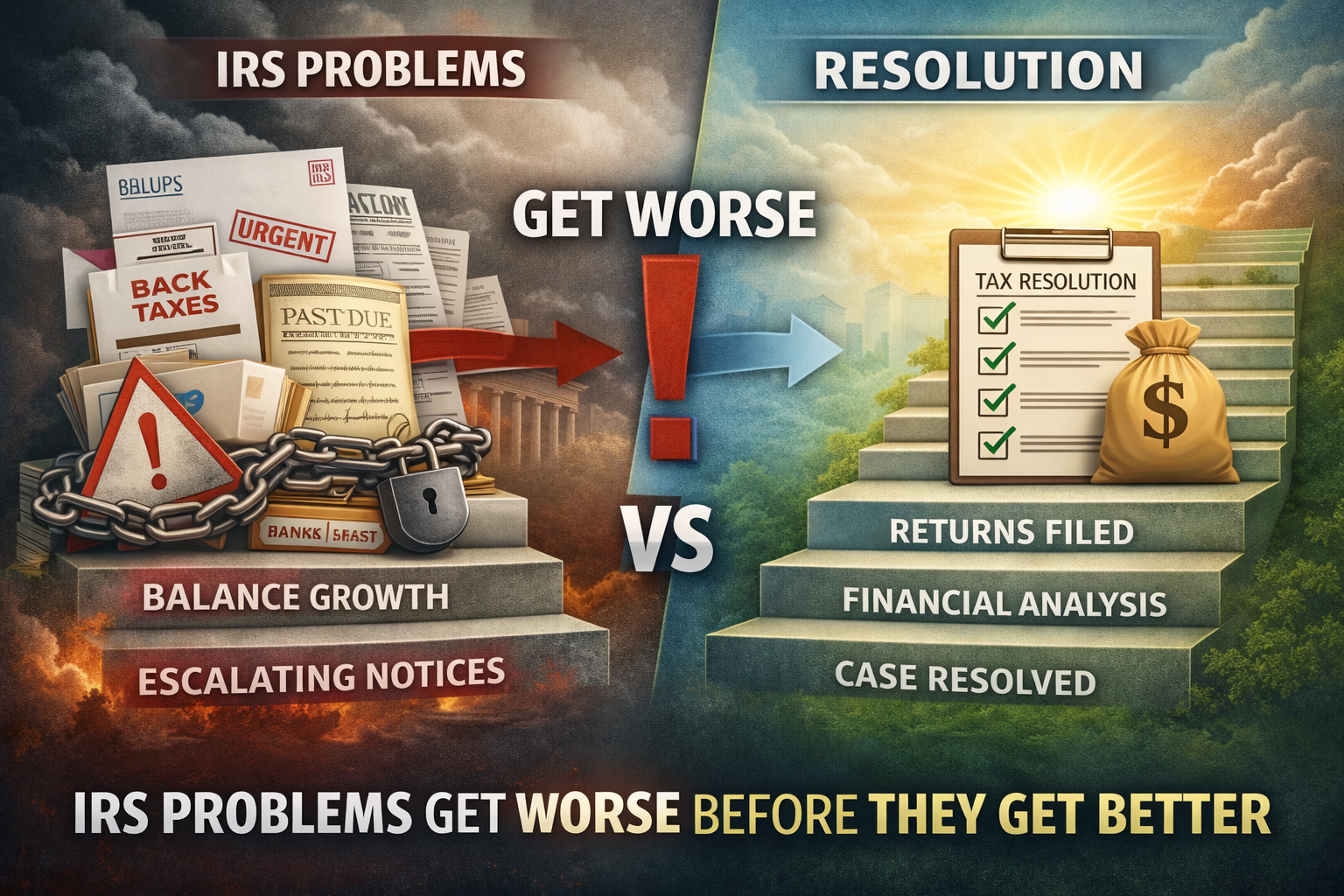

Ignoring a private collection agency may lead to lawsuits or credit damage. Ignoring the IRS leads to escalating enforcement backed by federal law.

That doesn’t mean the IRS acts without rules. There are procedures, protections, and resolution options. But the power imbalance is real, and treating IRS debt like ordinary consumer debt often leads to serious consequences.

Understanding what IRS collections can do—and what private collectors cannot—isn’t about fear. It’s about recognizing that tax debt operates under a different system, with different risks, and requires a different level of attention.