How the IRS Decides Which Assets to Seize

This is a subtitle for your new post

When people hear the word “levy,” they often imagine the IRS randomly seizing whatever it can find.

That isn’t how IRS enforcement works.

IRS levies are targeted decisions driven by efficiency, collectability, and enforcement leverage. The IRS’s goal is to collect tax with the least administrative burden—not to take property for its own sake.

The IRS generally starts with assets that are easy to reach and easy to convert into cash.

Bank accounts are often first. They are visible to the IRS, require no court order, and can be levied administratively once notice requirements are met. A bank levy freezes funds on deposit and captures what is available at that moment. From the IRS’s perspective, this is fast and cost-effective.

Wages are another frequent target. Wage levies are ongoing and require little follow-up once in place. Unlike most private garnishments, IRS wage levies leave only a small exempt amount, making them a reliable collection tool.

Income streams matter more than ownership.

If a taxpayer has regular income—wages, pension payments, retirement distributions, or other periodic payments—the IRS will usually target the income rather than seize the underlying asset. Holding income-producing property creates administrative problems and can reduce overall collections. The IRS is a tax collector, not a property manager.

That said, the IRS does seize vehicles, and vehicle seizures are far more common than seizures of real estate or operating businesses.

Cars are relatively easy to locate, tow, store, and sell. They do not require ongoing management, and their value is usually easier to determine than other assets. When a vehicle has equity and its seizure will not prevent the taxpayer from earning income, it can become an enforcement option.

Still, actual seizures of hard assets are rare.

According to the IRS Data Book, the IRS reported fewer than 100 property seizures nationwide in fiscal year 2022, including vehicles and real estate. This is in stark contrast to the hundreds of thousands of levies issued each year against bank accounts and wages. The data underscores that seizing physical assets is a last-resort enforcement action, not a routine collection tool.

Seizures of real estate or operating businesses are even less common. These actions require higher-level approvals and careful analysis to ensure that a sale would meaningfully reduce the tax debt after costs, liens, and complications are considered.

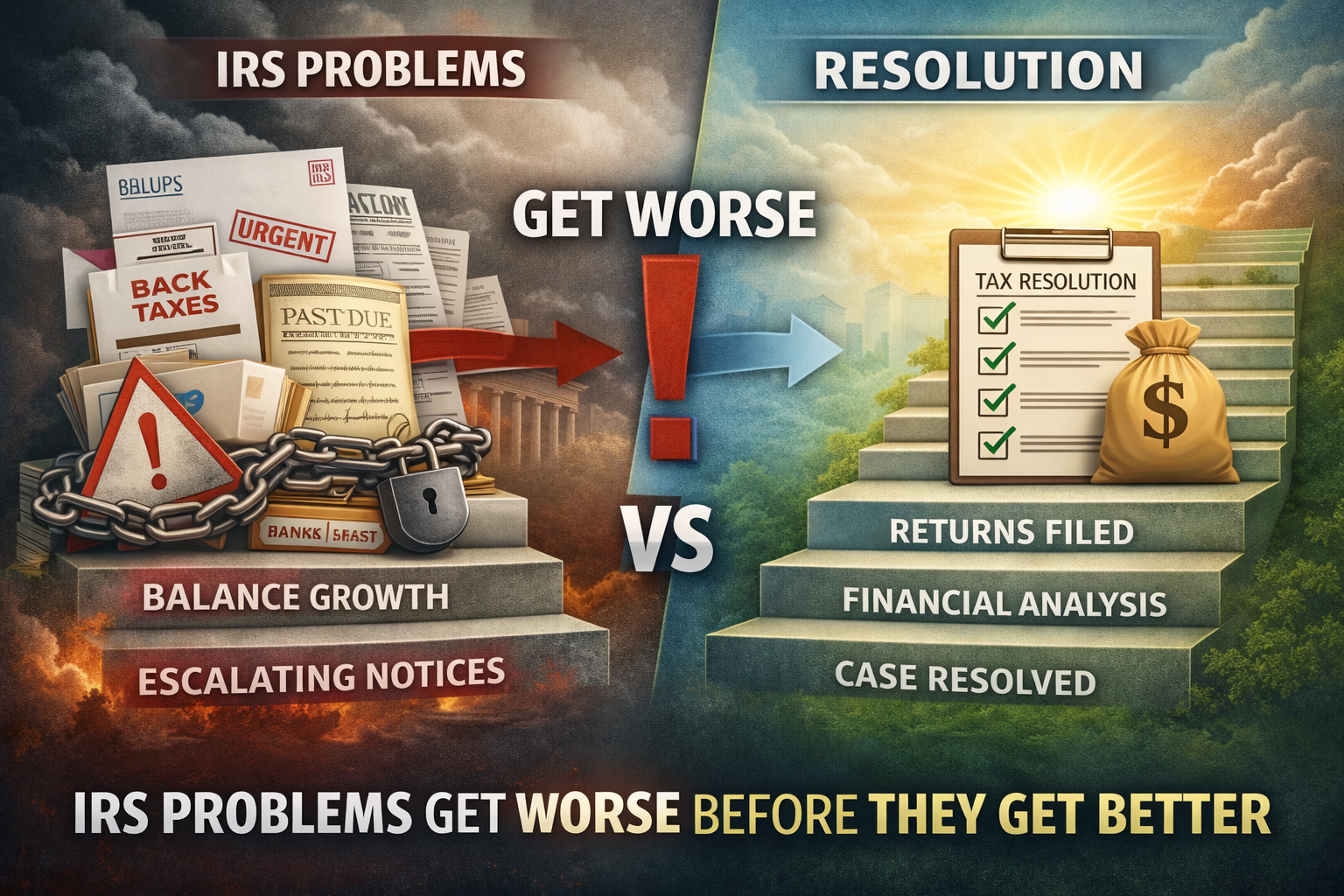

Taxpayer behavior also influences enforcement decisions. When returns are filed, communication occurs, and some effort is made to resolve the balance, enforcement often slows. When notices are ignored and deadlines are missed, the IRS is more likely to escalate.

Hardship is another factor. The IRS evaluates whether a levy would leave the taxpayer unable to meet basic living expenses or continue earning income. That does not prevent enforcement, but it does affect which assets are targeted.

The key takeaway is this: IRS levies are deliberate, not random. The IRS focuses on assets and income sources that are accessible, efficient to collect, and likely to produce results—reserving seizures of hard assets for situations where other methods have failed.

Understanding that logic does not eliminate risk, but it does make IRS enforcement more predictable. And predictability is often the first step toward regaining control.