IRS Collections at Thanksgiving: No One Wants a Tax Bill with Dinner

This is a subtitle for your new post

Thanksgiving is supposed to be about family, gratitude, and taking a breather before the end-of-year rush. But if you’re dealing with IRS collections, you might be wondering: Does the IRS take a holiday too?

The short answer: not entirely. While the agency isn’t out to ruin your Thanksgiving dinner, collection processes don’t go completely quiet just because the calendar says holiday season.

Here’s what actually happens around Thanksgiving — and what you should watch for if you’re in the collection stream.

The IRS Does Slow Down — But Only in Certain Areas

The IRS doesn’t actively push enforcement on federal holidays, and employees aren’t making phone calls or knocking on doors while you’re carving the turkey. But the broader collection system doesn’t stop running.

Key systems — automated notices, transcript updates, payment processing, levy cycles — continue based on their normal programming. That’s because most collection activity is handled by automated systems, not humans.

So while you won’t get a call from a Revenue Officer on Thanksgiving Day, you can still have:

- A CP14, CP503, or CP504 notice generated

- A wage levy continues to hit your paycheck

- The 21-day hold period on a new bank levy continues to count down

- Automated collections proceed in the background

It’s not personal — it’s just how the IRS’s systems operate.

What Won’t Happen Over Thanksgiving

Here’s what you don’t need to worry about during the holiday itself:

- No same-day levies or seizures

- No Revenue Officer field visits

- No human-initiated enforcement actions

IRS employees are off just like everyone else.

But Beware of Timing Issues Around the Holiday

Thanksgiving often falls during a critical window for taxpayers already in the collection pipeline. For example:

- If you received a Final Notice of Intent to Levy, your 30-day Collection Due Process (CDP) window won’t pause just because it's Thanksgiving week.

- Your bank levy’s 21-day hold period continues ticking even during federal holidays.

- If you're trying to submit financials, respond to an exam issue, or negotiate with a Revenue Officer, remember that staffing before and after the holiday is lighter — so delays happen.

Bottom line: the deadlines in IRM Part 5 continue running, regardless of turkey, travel, or football.

A Good Time to Reset Your Collection Strategy

Thanksgiving is often the unofficial start of “let’s fix this before next year.” And honestly, it’s a good moment to reassess:

- Are you eligible for an Installment Agreement?

- Would Currently Not Collectible (CNC) status protect you?

- Do you need to consider an Offer in Compromise?

- Is it time to finally respond to that levy notice or RO request?

Better to deal with IRS debt than drag it into the new year.

Final Thoughts

Thanksgiving isn’t a time when the IRS goes on the offensive — but it’s not a complete pause either. Automated processes keep moving, deadlines keep running, and existing levies keep hitting.

And that’s why no one wants a tax bill with their turkey.

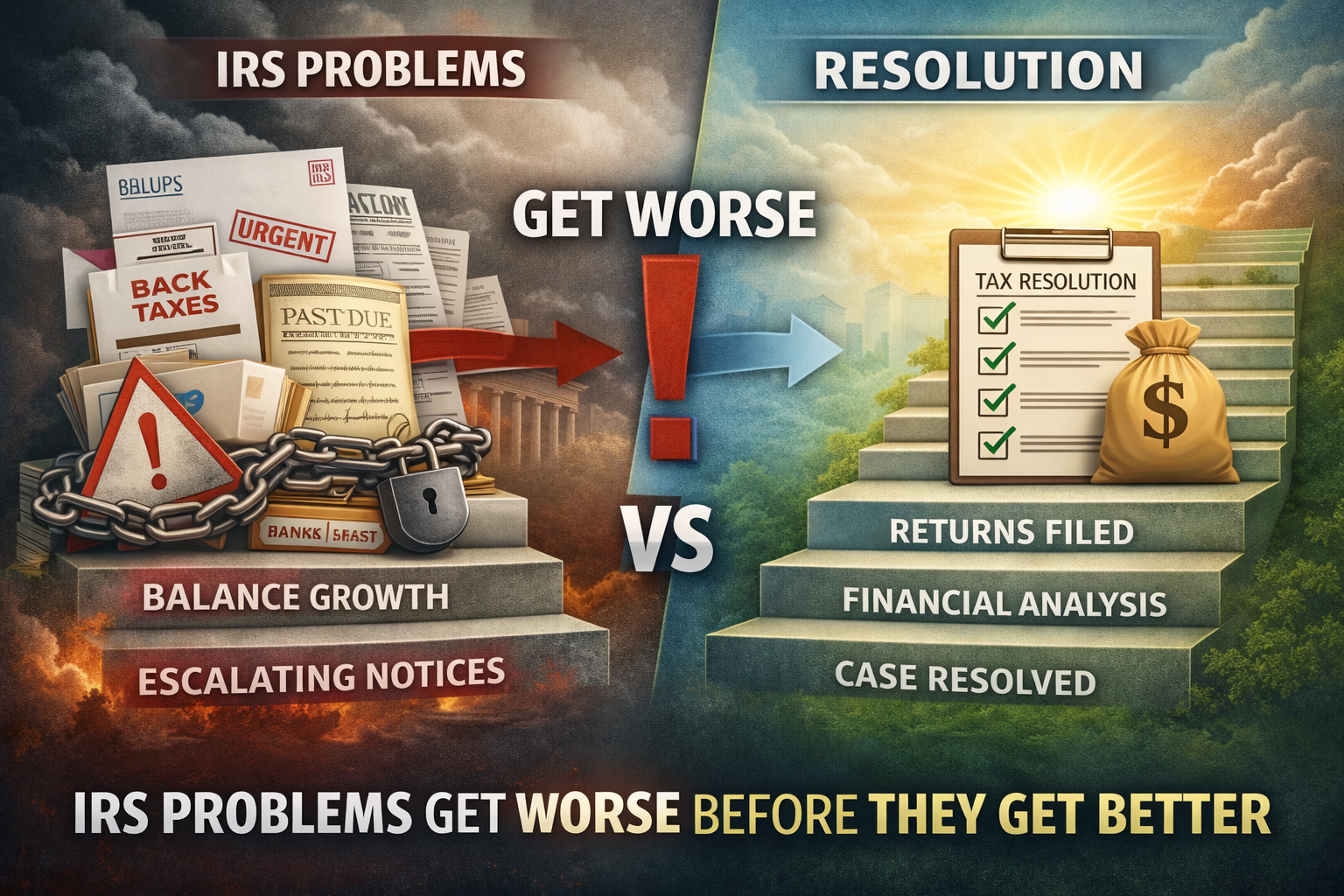

If you’re in the middle of IRS collections, Thanksgiving week is a perfect reminder to get ahead of the problem — before the new year brings another round of notices and pressure.