Why Some Taxpayers Are Better Off Filing in the Final Week

This is a subtitle for your new post

Once you’ve filed an extension, the filing deadline changes. And for many people dealing with IRS problems, that extra time is not about procrastination—it’s about accuracy and control.

The IRS does not release complete third-party income data early in the year. W-2s, 1099s, brokerage reports, retirement distributions, and other information returns are filed with the IRS on staggered schedules, and the IRS Wage & Income transcript that pulls them together is often not fully available until late May.

That matters if you have multiple income sources or a history of reporting problems.

Filing a return before all of that information is available can lock you into a version of the truth that doesn’t match what the IRS eventually sees. That leads to CP2000 notices, underreported income adjustments, amended returns, and audits—exactly the kind of secondary problems people with IRS debt don’t need.

An extension gives you time to let the IRS data settle.

Once Wage & Income transcripts are available, missing 1099s show up. Duplicate reporting becomes visible. Incorrect payers can be identified. Instead of guessing what the IRS thinks you earned, you can see it and reconcile against it.

That’s why filing in the final week before the extended deadline can be a disciplined strategy.

By then:

- Third-party income reporting has largely stabilized

- IRS transcripts reflect what the government actually has on file

- You can file a return that matches IRS data instead of fighting it later

For someone headed toward IRS representation, that alignment is critical. Resolution options—payment plans, hardship status, or an Offer in Compromise—are built on the numbers in the IRS system. Filing a return that matches those numbers avoids disputes that delay or derail the process.

There’s also a cash-flow angle. Filing later lets you see your financial picture more clearly before choosing how to handle what you owe. That matters when every dollar counts.

None of this means waiting without a plan. The extension is the plan. It creates compliance while preserving the opportunity to file correctly once the data is complete.

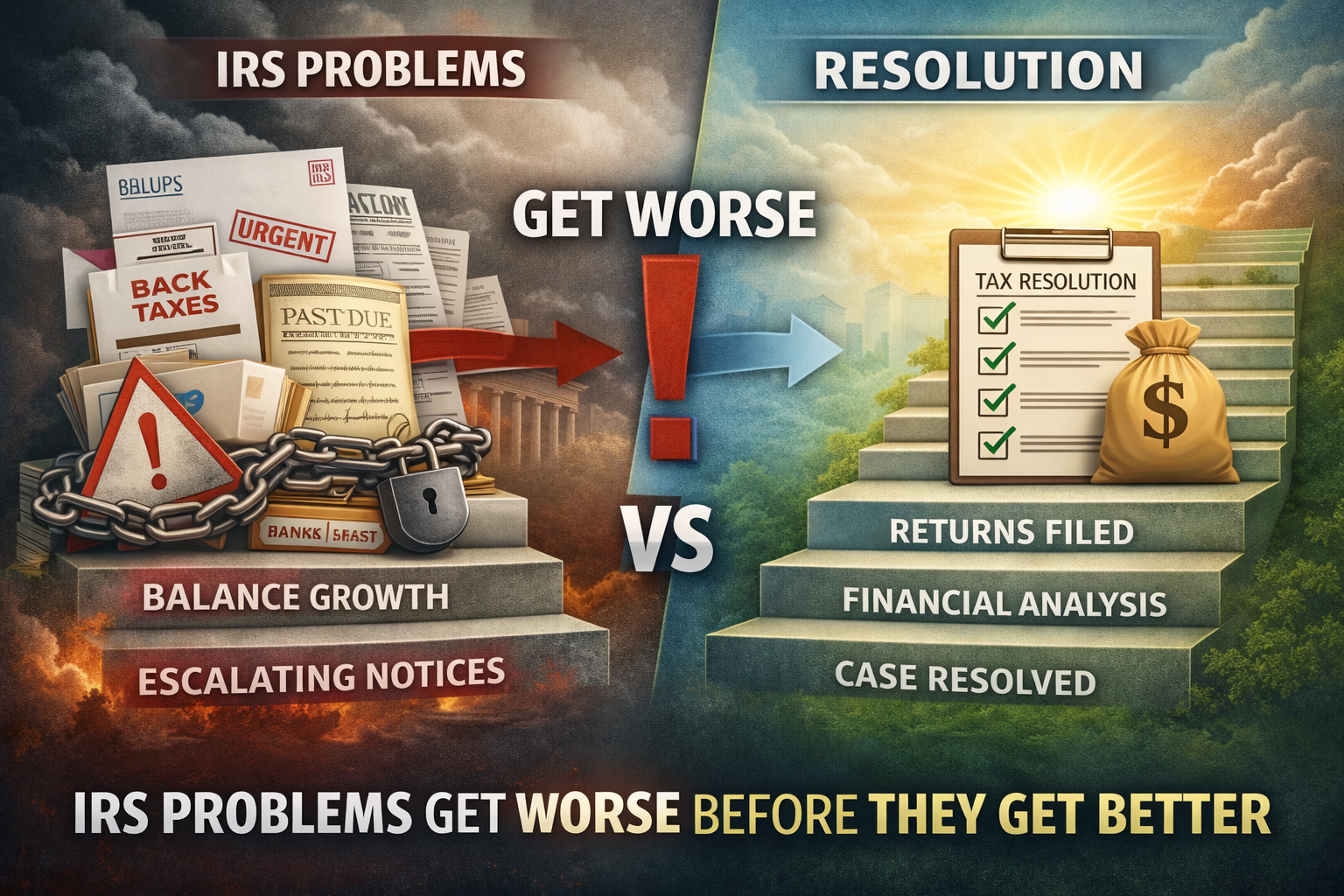

For taxpayers with IRS problems, the worst outcome isn’t filing late. It’s filing wrong—and then having to spend months or years undoing the damage.

Sometimes the smartest filing date is the last possible one.